Income Tax

All businesses except partnerships must file an annual income tax return. Partnerships file an information return. It depends on how your business is organized. Refer to Business which returns you must file based on the business entity established.

Estimated tax

Generally, you must pay taxes on income, including self-employment tax (discussed next), by making regular payments of estimated tax during the year. For additional information, refer to Estimated Taxes guidelines and rules.

Self-Employment Tax

Self-employment tax (SE tax) is a social security and Medicare tax primarily for individuals who work for themselves. . Social security coverage provides you with retirement benefits, disability benefits, survivor benefits, and hospital insurance benefits.

Employment Taxes

When you have employees, you as the employer have certain employment tax responsibilities that you must pay and forms you must file. Employment taxes include the following: 1- Social security and Medicare taxes 2- Federal income tax withholding 3- Federal unemployment (FUTA) tax

Excise Tax

This section describes the excise taxes you may have to pay and the forms you have to file if you do any of the following. 1- Manufacture or sell certain products. 2- Operate certain kinds of businesses. 3- Use various kinds of equipment, facilities, or products. 4- Receive payment for certain services.

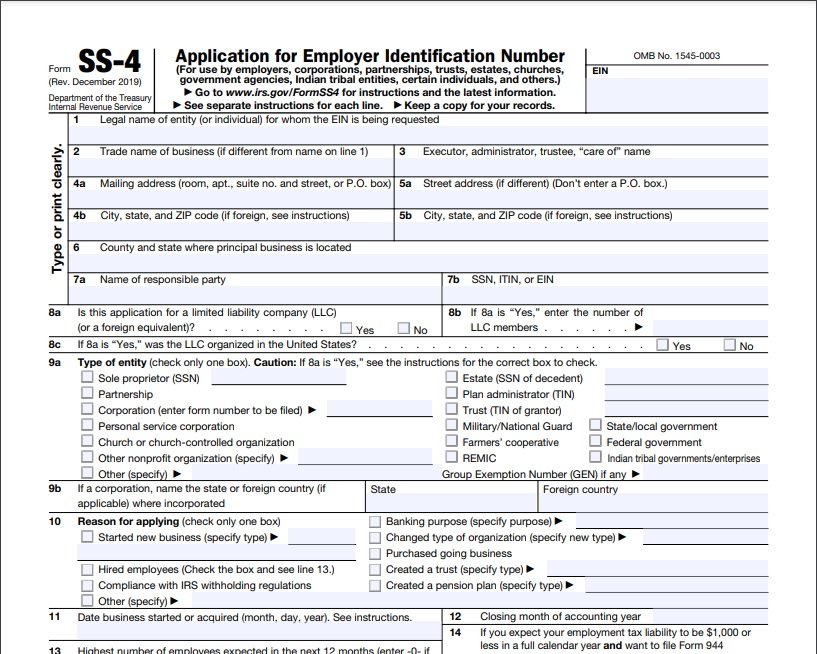

EIN

An Employer Identification Number (EIN) is also known as a Federal Tax Identification Number, and is used to identify a business entity. Generally, businesses need an EIN.

We help you get your EIN for your business

Filing for Tax Exempt Status?

It’s best to be sure your organization is formed legally before you apply for an EIN. Nearly all organizations are subject to automatic revocation of their tax-exempt status if they fail to file a required return or notice for three consecutive years.

Change of Ownership or Structure

Generally, businesses need a new EIN when their ownership or structure has changed. Refer to "Do You Need a New EIN?" to determine if this applies to your business.

Verify Your EIN

If you want to verify your EIN, see the Lost or Misplaced Your EIN page for instructions.

Daily Limitation of an Employer Identification Number

Effective May 21, 2012, to ensure fair and equitable treatment for all taxpayers, the Internal Revenue Service will limit Employer Identification Number (EIN) issuance to one per responsible party per day.

Our clients say

We have over ten years of experience with top business professionals

Kevin Bray

Matrixo CEO & Founder

My day to day work requires me to be on top of business affairs worldwide. This is where the offices of Shuster & Shuster help me out.

Melina Matsoukas

DOBL Customer Manager

As a representative of the law offices of Simon Brinks, I get all my professional advice from Mr Shuster himself. What an inspiration!

Business Tax Services

"Reyna Agency Solutions Inc. (RAS) provides a wide range of services for individuals and businesses, from car insurance to fill requests . When we offer comprehensive solutions, we mean the convenience of solving various needs in one place. Our goal is to save you time and worry so you can focus on what is most important to you. At RAS our clients will always find a warm, professional treatment and in their own language"

WE PROVIDE BEST TAX SERVICES

WE PROVIDE FOLLOWING BUSINESS TAX SERVICES

WE PROVIDE BEST TAX SERVICES

Employer Identification Number

All you need to know about EIN

Filing for Tax Exempt Status?

It’s best to be sure your organization is formed legally before you apply for an EIN. Nearly all organizations are subject to automatic revocation of their tax-exempt status if they fail to file a required return or notice for three consecutive years.

Change of Ownership or Structure

Generally, businesses need a new EIN when their ownership or structure has changed. Refer to "Do You Need a New EIN?" to determine if this applies to your business.

Verify Your EIN

If you want to verify your EIN, see the Lost or Misplaced Your EIN page for instructions.

Daily Limitation of an Employer Identification Number

Effective May 21, 2012, to ensure fair and equitable treatment for all taxpayers, the Internal Revenue Service will limit Employer Identification Number (EIN) issuance to one per responsible party per day.

ABOUT US

We are dedicated to providing professional service with the highest degree of honesty and integrity, and strive to add value to our tax and consulting services.

- Highly Competent Professionals

- Affordable Prices

- High Successful Recovery

26

Consultants

546

Happy Clients

15

Years of Experience